Cover

NNPC Raises Petrol Price to ₦887 per Liter Amid Economic and Industry Uncertainties

Published

4 months agoon

Agnes Ekebuike

Newslens NG reports that The Nigerian National Petroleum Corporation (NNPC) has announced an increase in petrol prices to ₦887 per liter, a development that has significant implications for the country’s economy and the daily lives of Nigerians.

This Nigerian Newspaper reports that Chairman of the Energy Transition Group of the Nigerian Gas Association and CEO of Cabtree, Olabode Sowunmi, provided a detailed analysis of the situation. Sowunmi emphasised that the pricing of crude oil, as a globally traded commodity, is determined by a range of economic fundamentals. “Crude oil is a commodity with uniform pricing globally, which means its price will generally fall within a certain range around the world,” he explained. He further noted that the costs associated with refining are similarly standardized, leading to relatively consistent petrol prices globally.

However, Sowunmi highlighted the impact of Nigeria’s fluctuating currency on petrol prices, pointing out that “the day the naira falls against the dollar, the price of petrol changes accordingly.” He criticised the government’s historical lack of political will to adjust petrol prices in line with these fluctuations, which often led to the implementation of subsidies.

Sowunmi also underscored the role of local refineries, particularly the Dangote Refinery, in potentially stabilizing prices. “The advantage of local refineries like Dangote’s lies in their ability to purchase crude oil in naira, avoiding the pressures of procuring dollars,” he said. This, in turn, obligates the refinery to price its products in naira, which could offer some insulation from the volatility of international currency markets.

Despite these potential benefits, Sowunmi expressed uncertainty about whether the Dangote Refinery’s production would fully meet Nigeria’s demand for refined products. He pointed out that until Dangote’s operations are fully monitored, particularly the tracking of every truck leaving the refinery, the actual daily consumption of petroleum products in Nigeria remains unclear.

Sowunmi also addressed the economic realities facing the Dangote Refinery, noting that it is a business that must remain profitable. “Dangote is a business person with shareholders; he’s not going to run the refinery at a loss. They will price their products competitively and in a way that ensures profitability,” he said. This could mean that prices may fluctuate based on market conditions, including the parity of the naira to the dollar.

Moreover, Sowunmi highlighted the issue of potential monopoly, citing the Federal Consumer Protection Act, which defines any business with over 40% market share as a monopoly. He suggested that while monopolies are typically frowned upon in free markets due to historical reasons, the situation with Dangote could require careful regulation to prevent market distortions.

The ongoing debate over the introduction of subsidies was also touched upon. Sowunmi acknowledged that whether to reintroduce subsidies is a matter of policy and ultimately a decision for the government. However, he pointed out that any gap between the cost of petrol at the pump and the true cost of production must be accounted for, hinting that without subsidies, such gaps would need to be addressed by other means.

As Nigerians brace for the impact of the new petrol prices, the discussion surrounding the sustainability of current economic policies, the role of local refineries, and the possibility of government intervention remains crucial in determining the future of the country’s energy landscape.

Advertisement

You may like

-

NNPCL: Why President Tinubu Should Listen To Primate Ayodele’s Warnings

-

Kyari, Primate Ayodele, and the unresolved petrol hassle

-

How NNPCL Boss Mele Kyari Allegedly Wasted Millions Of Naira Sponsoring Falsehoods Against Lagos-Based Prophet

-

Between Respected Primate Ayodele, Embattled Mele Kyari and The NNPCL Dogs

Click to comment

Banking/Finance2 days ago

Polaris Bank Wins SERAS Award, Africa’s prestigious Sustainability/CSR recognition

Cover3 days ago

Breaking: Speaker Obasa Debunks Allegation Of Spending N17b On Assembly Gate

Agriculture4 days ago

TPI Conference on Skills Acquisition: Tinubu Pledges Implementation of Reports

Agriculture5 days ago

Glo launches affordable roaming bundles for Nigerians across 40 countries

Banking/Finance5 days ago

FIRSTBANK KICKS OFF DECEMBERISSAVYBE 2024 WITH KENNY BLAQ‘S ‘RECKLESS’ MUSICOMEDY

Cover1 week ago

100 Fulfilled Prophecies Of Primate Ayodele In 2024

Cover1 week ago

Tinubu Working To Bring Smiles To Nigeria, Obasa Says

Banking/Finance1 week ago

First Bank Denies Fraud Incident allegation, Says Report not Factual

Cover1 week ago

Aare Adetola Emmanuelking Honored with Prestigious OSCOTECH Fellowship Award

Cover1 week ago

PRESIDENT TINUBU TO OPEN APC THINK TANK CONFERENCE ON SKILLS ACQUISITION

Cover1 week ago

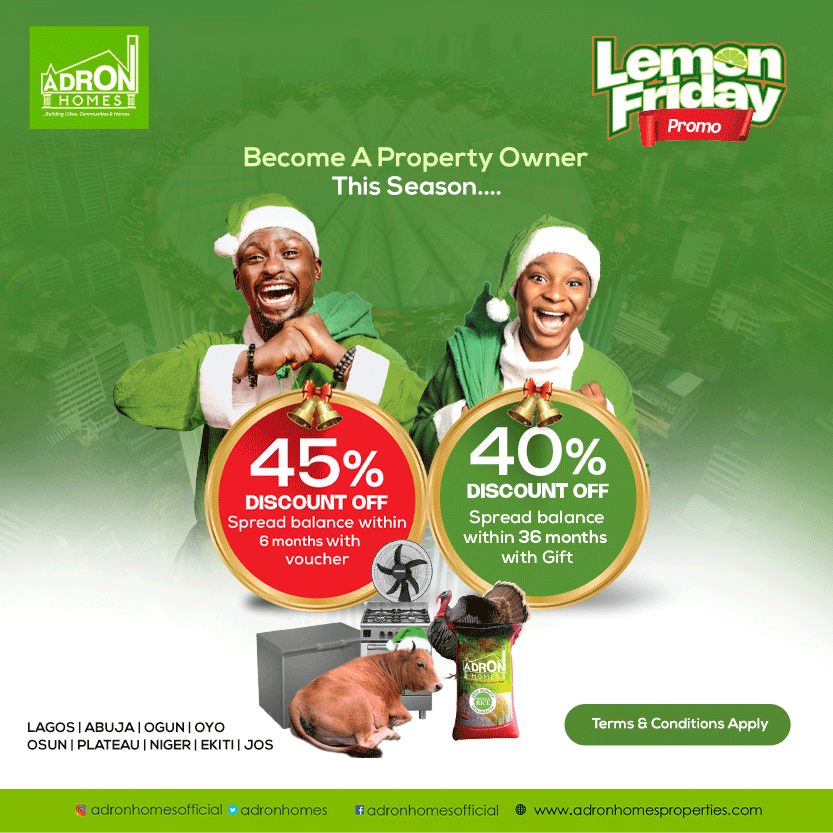

Ogun State Government Issues Certificate of Occupancy to Adron Homes Estates in Shimawa

Cover2 weeks ago

Polaris Bank receives sectoral recognition at 2024 NECA Employers’ Execellence Awards

Cover2 weeks ago

Lagos commissioner for Agric, Abisola Ruth Olusanya Lauds Moneymaster PSB on partnership

Cover2 weeks ago

Breaking: Vinicius Junior Returns for Champion League Clash against Atalanta

Cover2 weeks ago

VIDEO: Shettima Knocks Kemi Badenoch over ‘Denigrating’ Comment About Nigeria