Cover

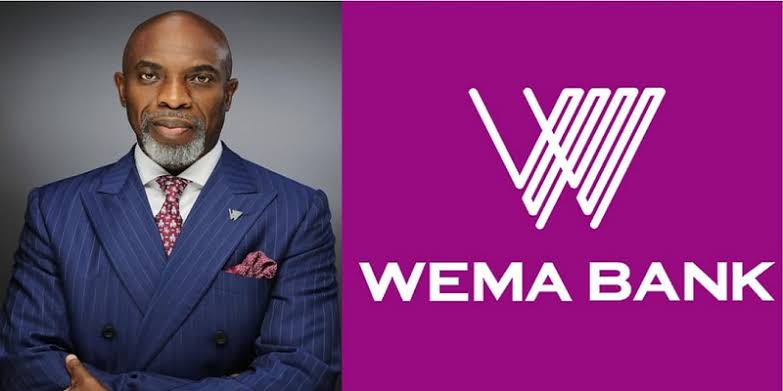

Wema Bank’s Legal Woes: Over N9 Billion in Litigation Costs Amid Recapitalization Efforts

Wema Bank PLC, headed by Moruf Oseni, has reportedly incurred over N9 billion in court cases as of December 2023. This news comes as the Central Bank of Nigeria’s bank recapitalization efforts loom on the horizon.

The bank’s full year 2023 financial statement, released recently, revealed an increase in litigation claims from the previous year. In 2022, litigation claims amounted to a little over N8 billion, while in 2023, they reached over N9 billion.

This suggests that the bank faced additional legal challenges in 2023. The nature of these challenges and their implications for the bank remain unclear.

These legal costs may pose a significant setback for the bank as it prepares to meet the new capital requirements. The details of the cases and their implications for Wema Bank’s future remain unclear.

As of September 2023, the bank’s litigation claims stood at N8.067 billion. However, in just three months, the claims increased significantly.

While litigation is a common risk for businesses, continued growth in claims can pose a serious financial burden. This could negatively impact the bank’s operations and financial health.”

The increase in litigation claims could have a negative impact on Wema Bank’s reputation, potentially leading to the loss of customers or partners. In addition, the bank has a history of flouting laws, which has resulted in hefty fines in the past.

We will continue to monitor this developing story.

With the increase in legal claims and the bank’s history of non-compliance with regulations this could pose a significant challenge to its financial health and operations.

It will be interesting to see how the bank responds to these challenges in the coming year